Forex Trading Education

Forex trading courses for BEGINNERS

AIMS Stress Free Trading offers full forex, stocks and crypto trading programs. This includes premium level in-depth video tutorials of everything a you need to know about forex trading.

Whether you're a beginner just starting now or experienced trader, AIMS trading strategies will help you excel in your trading and achieve your financial goals.

Forex Trading Books and articles for beginners

AIMS Stress Free Trading Strategies are fully explained through video and text. You will have access to our trading books in pdf format as well as webpages.

Free Forex Courses

FREE Forex trading courses for BEGINNERS

AIMS Stress Free Trading offers full forex, stocks and crypto trading programs. This includes premium level in-depth video tutorials of everything a you need to know about forex trading.

Whether you're a beginner just starting now or experienced trader, AIMS trading strategies will help you excel in your trading and achieve your financial goals.

FREE Forex Trading Books and articles

AIMS Stress Free Trading Strategies are fully explained through video and text. You will have access to our trading books in pdf format as well as webpages.

Get the #1 Best Indicator Today

Get this Fully Tested, Proven Algorithmic Trading Indicator

100% Tested Indicators

MT4 and TradingView Indicators and scripts

We have developed proprietary trading software that gives us a tremendous edge in the market.

Every Indicator we have coded has been tried and tested by our expert traders and coders.

You get several different trading strategies to learn and each strategy has its own set of indicators and trading algorithms.

100% Tested Indicators FREE

MT4 and TradingView Indicators and scripts

We have developed proprietary trading software that gives us a tremendous edge in the market.

Every Indicator we have coded has been tried and tested by our expert traders and coders.

You get several different trading strategies to learn and each strategy has its own set of indicators and trading algorithms.

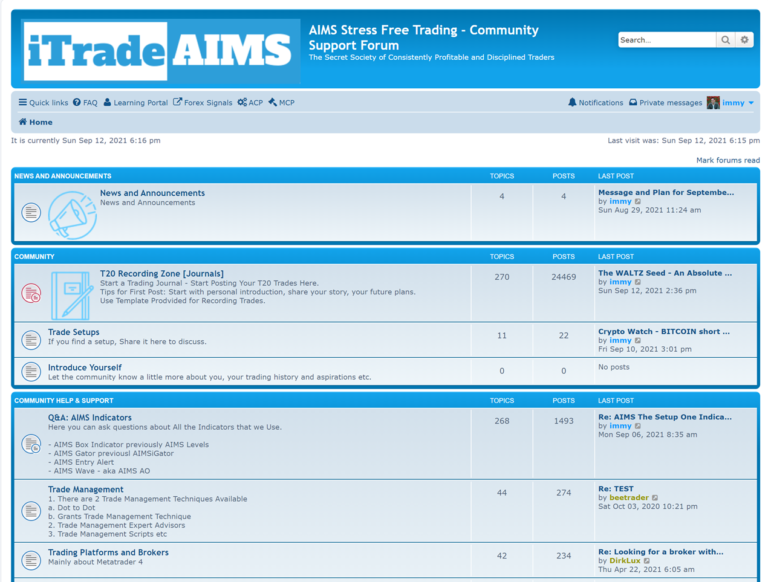

Community

bulletin board and discord server

AIMS Stress Free Trading has a thriving global community. Join our forex forum to meet people from all over the world. You will find a like-minded trader from as far as Australia, China and India, or United States, Canada or Brazil or from our home base in Europe.

AIMS Forum is a place where you will meet friendly and supportive fellow traders.

The Trading Forum serves as hub for traders to interact as well as keep records of their trades. The best way to stay disciplined and being true to yourself is to keep a trading journal. We have a special place for it in the forum.

Community

bulletin board and discord server

AIMS Stress Free Trading has a thriving global community. Join our forex forum to meet people from all over the world. You will find a like-minded trader from as far as Australia, China and India, or United States, Canada or Brazil or from our home base in Europe.

AIMS Forum is a place where you will meet friendly and supportive fellow traders.

The Trading Forum serves as hub for traders to interact as well as keep records of their trades. The best way to stay disciplined and being true to yourself is to keep a trading journal. We have a special place for it in the forum.

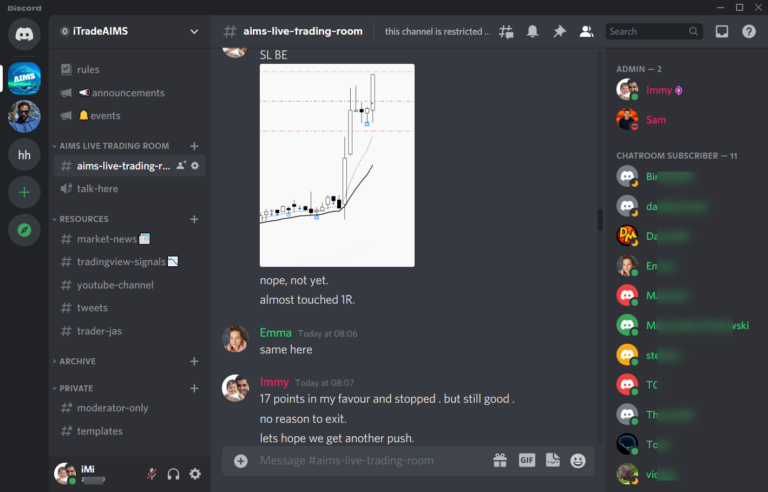

Trading Room

AIMS Live Trading Room

Trade live with Immy and other day traders. Get live trade signals, on spot expert analysis and forecasts. Chatroom is open 24/7.

There is no place like AIMS Live Trading Room.

Chatroom Trading Schedule

London Open: 8am - 10am (GMT) [Live Trading Session via Discord] US Session : 1.30 pm to 4pm (GMT) [Live Trading Session via Discord] We also share Forex Trade Ideas, Analysis, Forecast and Trading Signals throughout the day.

Trading Room

AIMS Live Trading Room

Trade live with Immy and other day traders. Get live trade signals, on spot expert analysis and forecasts. Chatroom is open 24/7.

There is no place like AIMS Live Trading Room.

Chatroom Trading Schedule

London Open: 8am - 10am (GMT) [Live Trading Session via Discord] US Session : 1.30 pm to 4pm (GMT) [Live Trading Session via Discord] We also share Forex Trade Ideas, Analysis, Forecast and Trading Signals throughout the day.

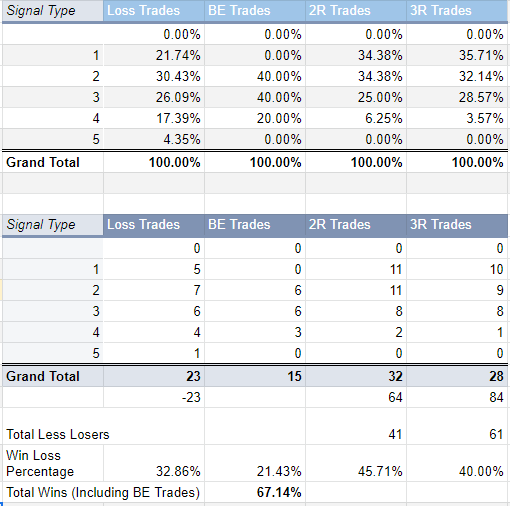

Check out the results of our students

A $250,000 Funded account

Starting in Jan 2022, he won a $250,000 account in Just 1 Week and by the End of January 2022, we already got paid real dollars.

$15,103 First profit payment

He shared with us when he received his First Payout within the first month: He Received $15,103 of his share of the profit.

Testimonials

Subscribe to Get The #1 Best Forex Entry Indicator

BONUS: Buy the Banana License and we will Give You All the Courses and Material Absolutely FREE.

Platinum Membership Was $1997 Today FREE

What's Included in Your Subscription

- iTradeAIMS - The BANANA Indicator

- AIMS Forex Trading Courses (6 Strategies)

- AIMS Forex Trading MT4 and TradingView Indicators (Proprietary Software)

- Daily and Weekly Recap & Forecasts

- AIMS The Setup, The Fruit, The Hunt and The LOBOT Trading Systems

- AIMS Day Trading Scalping System

- Daily and Weekly Forex Signals and Analysis

- Exclusive Access to AIMS Community Forum

- AIMS Live Trading Room Discord Server (Trade Live)

- Education Material Added Every Month Since 2011

- 24/7 Support from Our Expert Traders via Forums